- The Woof

- Posts

- Clinical proof just became the new premium in pet nutrition

Clinical proof just became the new premium in pet nutrition

What The Farmer's Dog's $660K investment means for your brand

Issue #257

October 22, 2025

Running a busy practice means juggling patient care, client communication, and endless notes. That’s where VetRec comes in — the AI Assistant trusted by top practices like Modern Animal, BondVet, Ethos, and Cornell.

VetRec instantly generates SOAP notes, surgery reports, dental charts, and more — all fully customizable and seamlessly integrated with your practice management system. It’s built to save you time, keep your records accurate, and help you focus on what matters most — patient care.

"All I do is read over the recorded notes, revise as needed, attach to medical records, and then I’m done. It’s a game changer!"

— Whitney C. Terrell, DVM

The VetRec x Woof Partner Offer:

Start with a 14-day free trial here

Use code THEWOOF for 50% off your first month

Quick Hits:

The Farmer's Dog made a move that should have every pet wellness brand paying attention - though maybe not for the reason you'd think.

They just unveiled results from a year-long Cornell University study on canine aging, investing $660,000 in what amounts to a credibility play that few startups can match.

Sure, the results showed what many in this industry would expect: fresh-fed senior dogs had lower levels of aging biomarkers and better metabolic profiles than kibble-fed dogs.

You might be nodding along thinking "of course they did," or you might be skeptical about the specific kibble used as a control, or question aspects of the methodology.

That's fair.

But here's what you can't dismiss…The Farmer's Dog just wrote a six-figure check to an Ivy League veterinary school for peer-reviewed, published research that will live in scientific literature forever.

They're not the first to fund studies, but they're one of the first DTC pet food startups to go this hard into academic validation.

The strategic implications matter more than the science itself.

This isn't about convincing you that fresh food outperforms kibble. This is about a brand building a competitive moat with published data that speaks directly to skeptical pet parents scrolling Amazon reviews at 11 PM, wondering if the premium price is worth it.

This is about earning veterinary recommendations in a market where "fresh" has been dismissed as trendy and unproven.

And most importantly, this is about setting a new bar that competitors will now have to meet or risk looking like they're hiding behind marketing copy.

What the Cornell Study Actually Shows

The scope of this research sets it apart from typical pet food studies.

The Farmer's Dog partnered with Cornell's veterinary school to track 22 geriatric Alaskan sled dogs, all aged 12 years or older, over a full year.

Half received a TFD’s chicken recipe diet, while the other half ate kibble. However, before splitting into two groups they all ate the same kibble for the first 4-months.

Blood and serum tests conducted at regular intervals tracked hundreds of metabolic markers at 0, 1, 3, 6, and 12 months.

The results, published in the journal Metabolites, revealed clear physiological differences.

Fresh-fed dogs showed increased markers of muscle and brain energy metabolism, including higher levels of branched-chain amino acids, creatine, and ketones.

Their antioxidant levels also improved.

At the same time, these dogs had lower levels of AGEs and other pro-aging compounds compared to the kibble group.

What makes these findings particularly compelling is their timeline.

Many of these positive metabolic shifts appeared within the first month on the fresh diet and persisted throughout the entire year. This suggests the benefits weren't temporary or placebo-driven, but represented sustained physiological change.

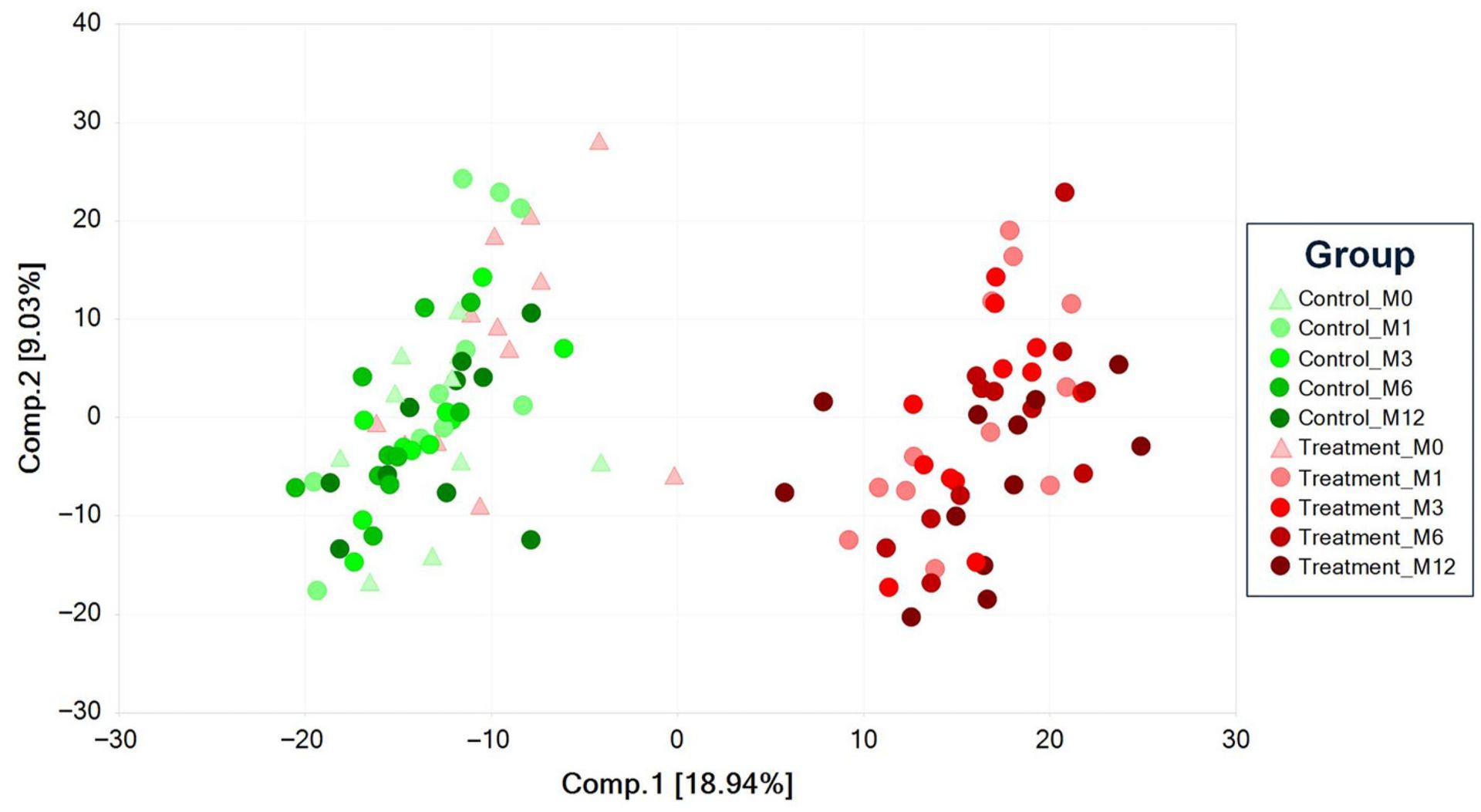

Gut microbiome composition comparing kibble diet vs fresh

👆️ Each point represents an individual dog’s gut microbiome composition at a given time point.

The plot compresses hundreds of microbial data points into two “components” (Comp.1 and Comp.2) that capture the biggest differences between samples.

Green points = Control group (fed conventional kibble)

Red points = Treatment group (fed The Farmer’s Dog fresh food)

Lighter shades = earlier months (M0 = baseline)

Darker shades = later months (M12 = one year)

Triangles mark baseline (M0) samples; circles are follow-up months.

Treatment dogs (red) show a progressive, structured shift, indicating a stable new microbiome equilibrium after dietary transition.

Dr. Joseph Wakshlag, one of the participating veterinary nutritionists, noted that the fresh diet…

"shifted the dogs' metabolism towards a beneficial profile in the aging dog…with implications for improved muscle and neurological health."

This stands as among the first peer-reviewed studies to show measurable health differences in senior dogs fed a fresh commercial diet versus kibble.

The study didn't directly prove that fresh-fed dogs live longer, but it documented biomarkers associated with healthier aging, which serves as a meaningful proxy for longevity.

The study was published openly in Metabolites, and skeptics might note that company-employed nutritionists co-authored the study, which introduces potential bias. However, Cornell's involvement and the peer-review process provide significant safeguards.

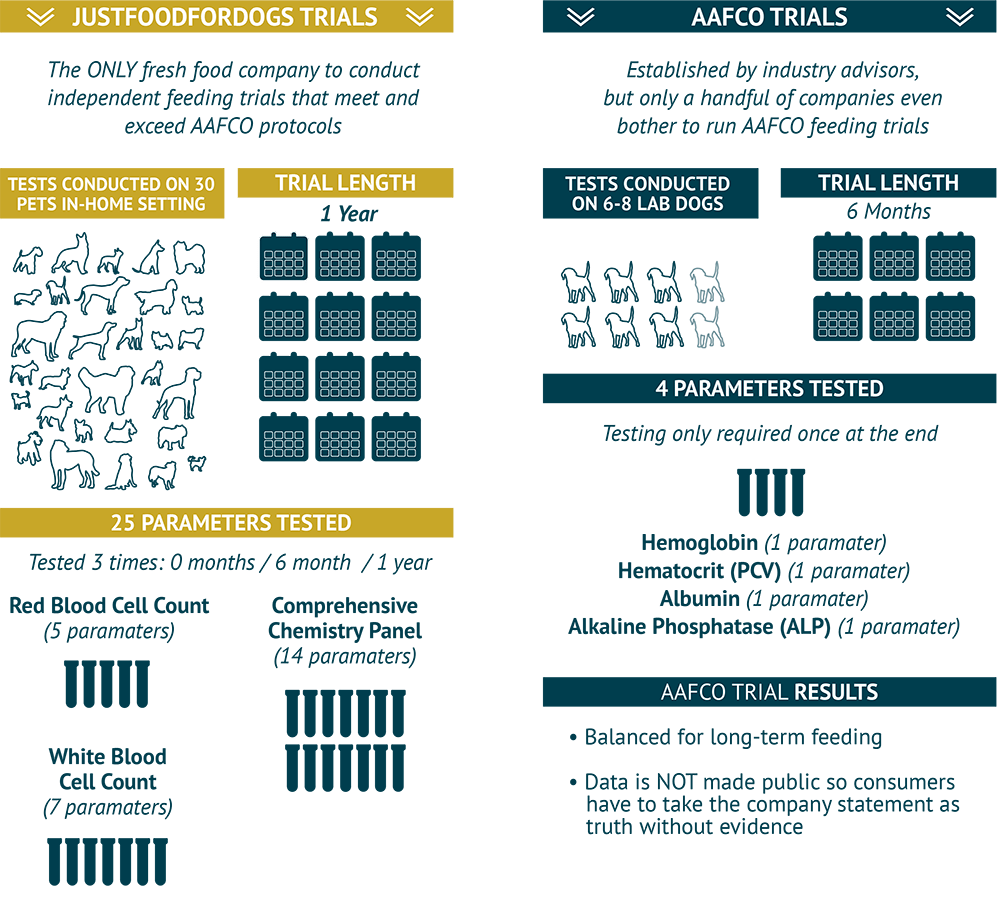

The study design itself sets a new benchmark. It goes far beyond the six-week AAFCO feeding tests used to validate basic nutritional adequacy.

This kind of rigorous clinical validation in pet food was previously almost exclusive to legacy companies like Purina, which conducted a landmark 14-year study showing that lean-fed dogs lived approximately 1.8 years longer.

Now, a well-funded startup has entered that arena, and the implications ripple across the entire industry.

The Senior-Dog Economy Drives Demand for Proof

The focus on older dogs reflects a fundamental demographic shift reshaping where companies invest their resources. Over half of dog-owning households in the U.S. now include a senior dog, defined as age seven or older.

That represents a dramatic increase from approximately 42% in 2012 to about 52% by 2022, translating to some 26.5M households with aging dogs.

Like the human population, the pet population is graying.

Improved veterinary care means dogs are living longer. This demographic shift has created an explosion in products targeting "gray muzzle" dogs. Senior dogs require more specialized nutrition and health care, and their owners have demonstrated a willingness to invest heavily.

The numbers tell the story. In a 2024 study, 97% of dog owners agreed that diet can influence their dog's longevity, signaling tremendous consumer appetite for products that promise longer, healthier lives.

This belief translates directly into spending. The healthy aging segment easily exceeds $10 billion annually in the United States alone.

The U.S. pet supplement market stands at approximately $1.2 to $1.5B in 2024, with much of that targeting older pets' joints, digestion, and anxiety.

The market is growing at about 6-8% annually.

Specialized senior pet foods account for another $1-2B in sales globally.

Pet parents with senior dogs represent high-value customers. Industry analysts note that the surge in senior pets is "fueling sales across veterinary services, chronic-condition medications, mobility and pain supplements, and specialized senior pet foods."

Brands that can win trust in this segment stand to gain loyal, long-term customers with significantly higher lifetime value.

Science as a Competitive Moat

The Farmer's Dog study exemplifies what happens when science becomes brand strategy.

By funding academic research and publishing peer-reviewed results, the company has effectively built itself a competitive moat. Independent, validated data can't be copied overnight by a competitor's marketing team.

First, it validates premium pricing and supports customer retention. Fresh pet food subscriptions often cost 2-4x more per day than kibble diets.

The Farmer's Dog can now point to Cornell study data showing measurable improvements in dogs' metabolic health, supporting a "clinically proven" narrative that helps reduce subscription churn.

Second, clinical validation earns veterinary trust. For decades, veterinarians have been trained to be skeptical of boutique diets and supplements that lack evidence.

Legacy companies like Purina and Hill's have long leveraged their research labs to gain vet endorsements. Now, newer brands are catching up.

JustFoodForDogs, a fresh food competitor, was an early adopter of this strategy. The company commissioned digestibility trials at a major university and became "the only fresh food company with proven digestibility" in a peer-reviewed study.

Those results showed JFFD's whole-food diets to be up to 40% more digestible than kibble, giving the company credibility with skeptical veterinarians.

JFFD now advertises that its Vet Support line is "the #1 veterinary recommended fresh food" based on an independent survey of 16,000 veterinarians.

That endorsement didn't come from clever advertising alone. It was earned by investing in veterinary nutrition expertise and research. Data published through Cornell carries weight in veterinary clinics in a way that glossy direct-to-consumer marketing never can.

Why Supplements Should Be Watching Closely

While fresh food companies are leading this evidence-based charge, the pet supplement industry should be paying close attention. The parallels are striking, and the same market dynamics apply.

The pet supplement market has exploded in recent years, with products targeting everything from joint health and digestive support to anxiety and cognitive function. Yet peer-reviewed clinical studies supporting these products remain relatively rare.

This creates a significant opportunity for differentiation.

Most supplement companies rely on ingredient lists and customer testimonials rather than controlled studies.

Pet parents are becoming more sophisticated consumers, researching ingredients and questioning vague claims.

Meanwhile, veterinarians who have grown comfortable recommending certain prescription supplements backed by research remain hesitant to endorse over-the-counter products that lack evidence.

Fifth & Fido marketing shows lots of clinical claims of their Turkey tail, but no study to back it up

The market opportunity is substantial.

In one 2024 survey, 83% of owners said they believe "gut healthy food" or supplements can extend their dog's lifespan, and 89% said it improves their dog's daily quality of life.

This suggests consumers are prepared to invest in proven health benefits.

A supplement brand that openly publishes its own evidence would likely earn outsized trust and loyalty from both pet parents and veterinarians.

While pet supplements are everywhere, pet supplement science remains rare, presenting a golden opportunity for companies willing to invest in validation.

Note: many pet supplement companies tout and showcase the science backed ingredients, but not necessarily their specific product formulation.

How Clinical Proof Translates to Business Outcomes

Data isn't just good for dogs. It drives multiple business advantages that directly impact the bottom line.

Pricing Power: A product that can claim clinically demonstrated benefits can justify premium pricing far more easily.

Pet owners have shown they will pay significantly more for products that credibly promise better outcomes.

Therapeutic veterinary diets sold through veterinarian channels often cost substantially more than super-premium retail foods precisely because they're backed by research.

The same logic applies to supplements. A company that proves its joint supplement improves mobility scores in arthritic dogs could command a higher price point, positioning itself more as a nutraceutical than a generic treat.

Channel Access and Veterinary Endorsement: Clinically validated products have a much easier time breaking into veterinary channels and specialty retail. Veterinarians and pet stores are inundated with supplement pitches. They tend to stick with brands that have recognizable quality seals or peer-reviewed research.

In the supplement world, Nutramax Laboratories grew Dasuquin and Cosequin into vet-favorite joint supplements partly by conducting trials published in veterinary journals and maintaining pharmaceutical-grade quality control.

Brands that accumulate scientific validation can open doors to veterinary clinic distribution and endorsements in veterinary literature.

Customer Retention and Engagement: A proven product creates a positive feedback loop with customers. Companies can turn study results into content, such as providing pet owners with timelines showing when to expect results.

The Farmer's Dog can now educate new customers on metabolic improvements observed after one month on their food, encouraging them to stick with it long enough to see benefits.

This data-driven storytelling strengthens customer commitment. If pet parents see the promised improvements, they become loyal advocates.

Having scientific backing also arms customer service and sales teams with credible answers when skeptical customers ask whether a product really works.

Investor and M&A Appeal: In the investment community, a pet wellness startup with clinical proof can differentiate itself from "me-too" brands.

It tells a stronger growth story, suggesting the company is setting new standards rather than just riding a trend.

Mars, Nestlé, and Colgate have all acquired smaller pet brands. A science-forward startup could command a premium if its research creates a defensible niche.

The Farmer's Dog explicitly earmarked $10M for veterinary research and clinical studies, signaling to investors that the brand is building an R&D moat.

At exit time, being able to show published research alongside sales numbers could bump up acquisition multiples.

For all the upsides of "clinically proven" pet products, brands must navigate several pitfalls carefully.

The most obvious risk involves managing bias and perception when research is brand-funded. For credibility, it's crucial to partner with reputable institutions and disclose all affiliations.

Full transparency about methodology, statistical significance, and limitations actually boosts trust. Brands should avoid the temptation to spin data too hard in marketing.

That leads to regulatory boundaries. In the United States, pet supplements occupy a gray zone. If a company makes aggressive health claims, the FDA's Center for Veterinary Medicine may consider the product an unapproved animal drug.

Recently, the FDA has issued warning letters to pet CBD companies for marketing claims that their products treat diseases without approval.

Every claim must stick to what was actually demonstrated. Marketing teams need education from regulatory advisors to avoid oversimplifying science into potentially misleading claims.

In the Cornell study, The Farmer's Dog can rightly say "reduced levels of certain aging biomarkers were observed", but it should not claim proof of extending dogs' lifespan, because lifespan wasn't directly measured.

Cost and access present another challenge.

Running university studies can cost hundreds of thousands of dollars, which may be prohibitive for small businesses.

This could widen the gap between well-capitalized market leaders and bootstrapped niche brands. One mitigation strategy might involve consortium studies or industry groups co-funding research that multiple companies can benefit from (e.g. the raw food movement).

Finally, brands must consider the optics of animal testing and welfare.

Pet owners are sensitive about how testing is conducted. The Farmer's Dog wisely conducted a long-term feeding study with sled dogs under ethical approval rather than using laboratory beagles in cages.

JustFoodForDogs proudly notes it refused to use caged lab animals and instead collaborated in more humane trials.

What Comes Next: Evidence as the New Normal

The pet wellness industry sits at an inflection point. We're entering an era where evidence isn't just nice to have. It will be expected.

We can anticipate a wave of pet food and supplement companies teaming up with universities and veterinary schools. Fresh dog food brands have broken the ice with Cornell, UC Davis, and University of Surrey, and supplement companies will likely follow.

It's easy to imagine a consortium of major joint supplement makers funding a mobility study in senior dogs.

Data will become a marketing currency. Instead of relying solely on testimonials, companies might advertise specific percentages of dogs showing improvement in clinical testing.

Veterinarians will tighten their product vetting as more brands claim to be "scientifically proven." We may see vet clinics develop approved product lists requiring a certain level of evidence.

Third-party verification and seals could emerge. Today we have the NASC seal for quality manufacturing and AAFCO nutritional adequacy statements.

In the near future, we might see new certification programs where an independent organization evaluates clinical research and grants a "Clinically Tested" seal.

The FDA's Center for Veterinary Medicine has already hosted sessions about regulating pet food claims for things like longevity and joint health.

Technology and longitudinal data integration will play an increasing role. With the rise of wearables and massive studies like the Dog Aging Project, there will be more data available than ever.

Wearables could become the new real-time data centers for tracking efficacy

Brands might integrate with these platforms.

Imagine a scenario where a calming supplement's efficacy is measured by reductions in a dog's nighttime restlessness as recorded by a smart collar.

Evidence Over Adjectives

The Cornell and Farmer's Dog study represents more than a one-off press release. It's a bellwether for an evolving era in the pet industry where we're witnessing a transition from marketing by adjective to marketing by evidence.

Terms like "premium," "natural," and "holistic" are ceding ground to phrases like "clinically studied," "veterinarian-tested," and "peer-reviewed."

Fresh pet food was once dismissed by many veterinarians as a trendy idea lacking proof. Now it has a foothold in scientific literature, and that changes the conversation.

For pet industry founders, operators, and investors, the implication is clear.

Embrace the science, or risk falling behind.

This doesn't mean every company needs a multimillion-dollar research budget, but it does mean that integrating real testing and transparent data should be part of the strategic plan.

Even small steps, like conducting a well-designed pilot study and publishing the results, can set you apart.

It also means being careful and honest in how results are used.

Credibility, once earned, can be quickly lost with one overhyped claim. The reward, however, is worth it.

The brands that invest in proof will occupy the high ground of trust. They'll win favor with veterinarians, attract more receptive customers, and likely capture the premium end of the market where margins are healthiest.

These companies will also help shape a healthier regulatory environment by proactively validating safety and efficacy.

As one veterinarian in the Cornell study remarked,

"these results are an exciting milestone for understanding canine health and nutrition."

The milestone isn't just the data itself. It's what the data represents, a shift toward science-backed innovation.

The pet companies that understand this will be the ones leading the pack in the years to come.

In a market where everyone claims to be premium, proof is becoming the only currency that matters.

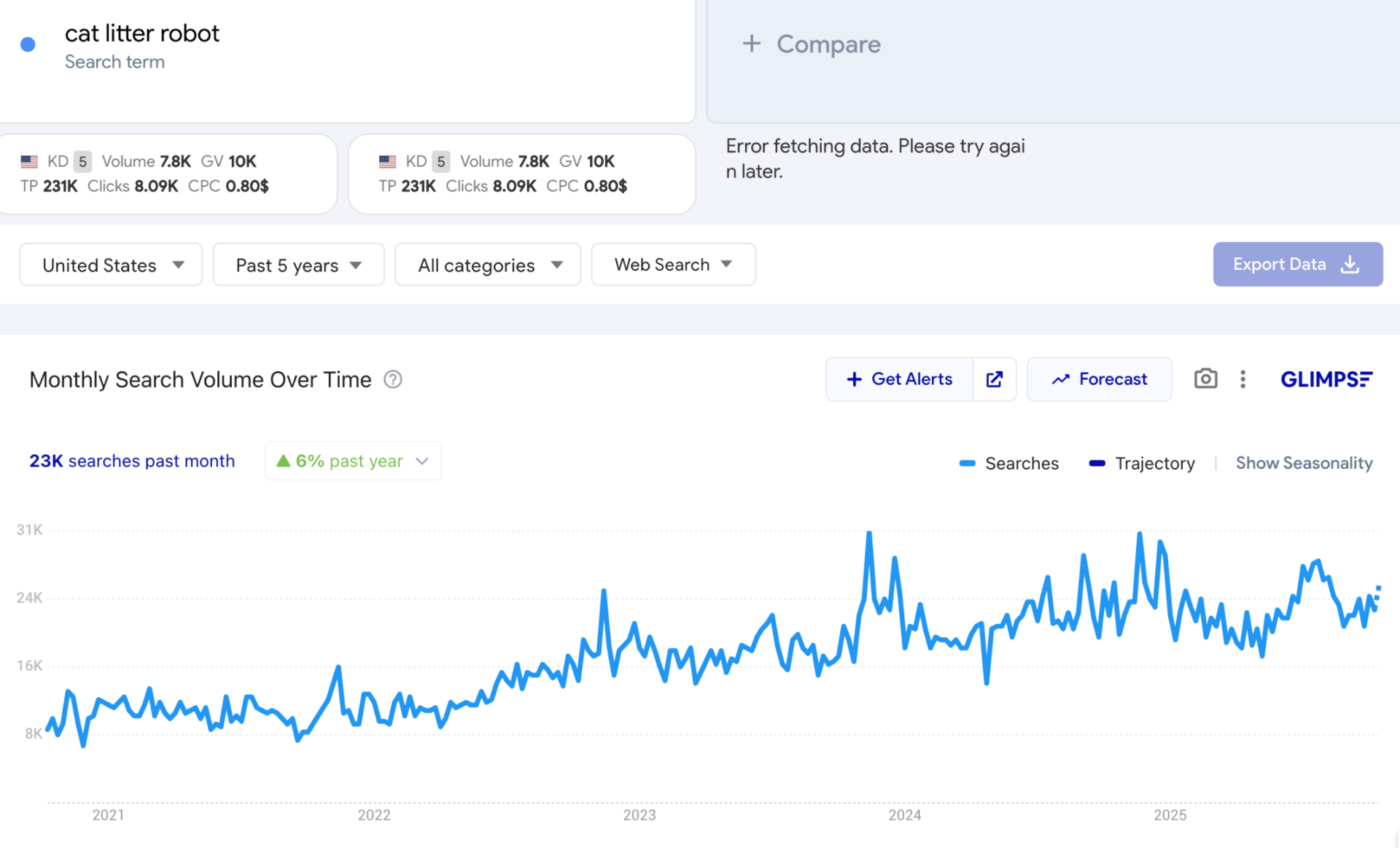

Search interest in “cat litter robot” has climbed steadily over the past five years, with a 6% increase YoY and a clear pattern of seasonal spikes each winter.

Those peaks are typically from November through early January, which line up with holiday buying cycles, when premium tech-driven pet products see the biggest lift.

The consistent upward trend suggests that automated litter boxes have moved beyond niche gadget status and are now an established category within connected pet care.

Heading into this holiday season, expect another surge. Whisker’s launch of the next-gen Litter-Robot 5 couldn’t be better timed, it adds AI-powered tracking and multi-cat insights just as consumers start upgrading or gifting higher-ticket pet tech.

For retailers, marketers, and investors, this is a signal that the smart litter space is entering its second wave - less about novelty, more about ecosystem and data integration.

See you Friday!