- The Woof

- Posts

- Pet services found their subscription model

Pet services found their subscription model

How memberships and passes are fixing the feast-or-famine cycle.

Issue #288

January 7, 2026

Quick Hits:

Pet service operators know the drill. One week your daycare is overbooked or your groomers are slammed. The next, you're staring at empty runs and wondering if you can justify keeping staff on payroll.

Holiday weekends create booking wars while January becomes a ghost town. This feast-or-famine cycle has defined the pet services industry for decades.

But something is shifting.

A growing number of pet businesses are borrowing a page from the subscription economy playbook, converting unpredictable, transactional services into recurring membership models.

And the results are worth paying attention to.

How NOT to do subscriptions

The Structural Problem

Pet services face a perfect storm of operational headaches.

Demand swings wildly with seasons and holidays, creating revenue whiplash and underutilized capacity that makes planning nearly impossible.

Labor constraints compound the issue since skilled groomers, trainers, and veterinary techs remain in short supply, and you can't staff up overnight when demand spikes.

The access problem is real for pet owners too.

According to APPA, 22% of U.S. pet owners are concerned about access to pet care services, citing difficulty getting appointments as a top issue. Meanwhile, customer retention remains paradoxically low despite high emotional attachment.

Pet parents consider their animals family, yet many service interactions stay transactional and infrequent. Without an ongoing program, even passionate owners drift between providers or book sporadically.

Compare this to the product side of the industry, where pet owners routinely buy food, meds, and supplies on predictable schedules through subscription services.

Chewy's Autoship, BarkBox, and countless others have proven that recurring revenue models work in pet. Services have simply lagged behind, traditionally treated as episodic events rather than continuous care.

This structural mismatch between emotionally invested customers and ad-hoc service delivery represents missed opportunity on both sides.

What Micro-Memberships Actually Are

Micro-memberships are narrowly scoped, service-based offerings that turn one-off pet care into ongoing relationships.

Think monthly grooming clubs, unlimited daycare passes, or bundled care packs designed around real operational constraints and pet owner needs.

The distinction matters.

These aren't generic all-you-can-eat subscriptions. They focus on access, priority, and smart bundling without breaking the existing business model.

A membership differs from a subscription in an important way.

While a subscription is simply a recurring payment for goods or content, a membership is a relationship that grants ongoing access to a service or community.

The privileges that come with membership, such as priority booking, exclusive hours, and member events, often prove as valuable as the included services themselves.

They're also more dynamic than punch cards or prepaid packages.

Those are finite transactions that don't inherently build ongoing loyalty beyond the prepayment.

Micro-memberships auto-renew and provide continuous benefits. A package is a one-time transaction.

A membership is an agreement that implies the customer will be back regularly.

The smartest programs use credits or tiers to balance value and usage. A common approach involves monthly credit memberships where customers pay a set amount for a specific number of daycare days that auto-renew.

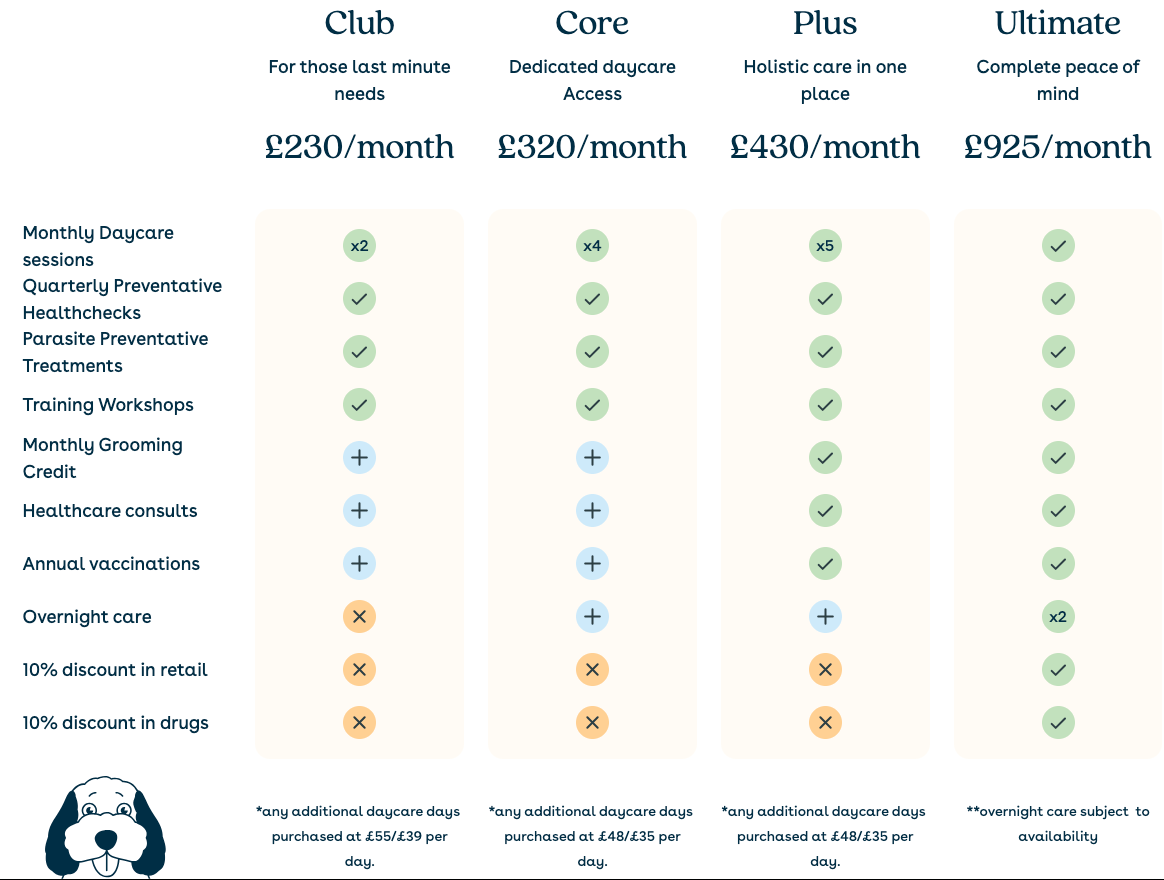

WagWorks has a wide range of tier and access for their members

This yields predictable revenue without truly unlimited use while segmenting heavy users from casual users into appropriate plans.

Where This Is Working

Grooming memberships — directly tackle the irregular scheduling that plagues both pet health and groomer schedules.

Scenthound, the grooming franchise, offers monthly wellness plans covering basic hygiene like bath, ears, nails, and teeth, then gives members discounted add-ons like haircuts as needed.

For operators, the model means predictable appointments rather than feast-or-famine bookings. Members come in on schedule, reducing guesswork about how booked next month will be.

You don’t need to be a large franchise to capitalize on implementing this.

In fact, I would argue that having the personal touch of an independent shop deeply embedded within a community would give you an edge vs a nationwide franchise.

However the problem I see with the smaller local shops is the execution and messaging around the memberships.

They are either confusing and difficult to read or filled with friction, which is where the Franchises outshine them by placing an emphasis on the clear messaging and online booking process.

For instance, these two local Austin daycare and boarding (+grooming) facilities (👇️) both offer memberships and on both of their pages they don’t even have a button to purchase one or even inquire.

One of them doesn’t even include a price.

A local Austin boarding facility that recently launched memberships, just has this chart on their memberships page.

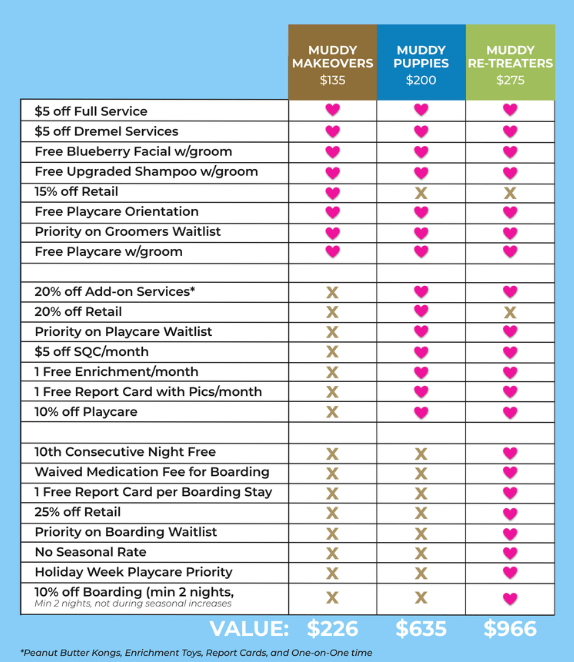

A local Austin dog daycare with no pricing shown anywhere on the membership page

Daycare passes — address the volatile weekday demand that makes staffing a nightmare. An unlimited or multi-day monthly pass grants members the ability to bring their dog without needing daily reservations, providing flexibility that busy pet parents love.

For operators, memberships dramatically improve capacity planning. Instead of wondering if next Tuesday will only have three dogs, you know you have a baseline of pre-paid member dogs likely coming throughout the month.

Private dog park memberships — have transformed what was once a race-to-the-bottom free service into premium experiences funded by recurring fees.

Members pay for cleaner facilities, stricter safety protocols, and verified vaccinations. As one owner described comparing a free park to a members-only option, you get a cleaning crew, safety gates, good lighting, and an employee on site.

The membership list doubles as a customer list for selling ancillary services like bar sales, training classes, or retail. Plus members make friends with other members which can really drive up retention.

The more innovative applications get interesting…

Behavioral maintenance clubs — extend client relationships beyond initial training courses, providing monthly tune-up classes or Q&A sessions with trainers. This monetizes the post-training period, which is usually an untapped opportunity, while keeping dogs on track.

Senior dog wellness passes — bundle services for aging pets, including priority vet consultations, monthly spa grooming with extra skin and coat care, and in-home check-ins. Industry surveys show pet owners want help navigating age-related challenges, and practices that support pets through every life stage build stronger loyalty.

Puppy year-one memberships — target overwhelmed new owners facing a flurry of needs from vaccinations to training to socialization. These turnkey solutions bundle preventative care, training classes, daycare introductions, and introductory grooms for a monthly payment. If you win loyalty in that first year, you likely have a client for life.

Reactive dog access passes — serve pets that don't thrive in traditional services. A daycare might reserve specific afternoons for reactive dogs with higher staff ratios and carefully managed play sessions. This turns pets that would normally be excluded into paying clients while serving a deeply grateful customer base.

Some facilities are experimenting with weather-triggered access offering rainy day passes or summer heat passes that let members drop dogs on specific weather conditions. This drives utilization exactly when you want it while monetizing weather volatility like an insurance premium.

Building the Funnel

Shifting to membership requires rethinking the customer journey from acquisition through retention.

The funnel starts with visibility.

Most pet owners still find services through Google searches, or maps. If your business isn't highly visible there, it's effectively invisible aside from IRL traffic.

Your acquisition messaging should hint at the membership value proposition early. Plant the seed that you offer something beyond standard one-off service.

Conversion happens at point of service.

When a pet owner books an initial grooming appointment or daycare trial, that's the moment to educate about membership.

Staff should mention it enthusiastically without overwhelming first-time customers.

Some businesses use trial memberships as conversion tools, offering a lower-priced intro period that eases customers in while capturing recurring billing information.

As this guide from Gingr notes, this approach works better than free trials that may not convert.

Onboarding makes or breaks retention.

Send a welcome message that feels personal and outlines how to take advantage of the membership.

Engage through multiple channels including email, SMS, and potentially a phone call. This shows you're not a faceless subscription but a caring partner. The onboarding period should educate, excite, and initiate regular usage.

Ongoing engagement keeps members active.

Send monthly usage nudges reminding them to use remaining benefits.

Build in surprise-and-delight perks occasionally.

Create members-only events or content. These touches deepen emotional connection, which research shows is a huge factor in pet owner loyalty.

Upselling means moving members to higher tiers or adding complementary services based on actual usage data.

The Metrics That Actually Matter

It's easy to get excited about vanity metrics like social media likes or raw sign-up counts. But sustainable success shows up in different numbers.

Lifetime value should increase significantly for members versus non-members. Consider a customer who comes for a $90 groom three times per year versus one converted to a $65/mo grooming maintenance plan.

That’s $270 vs $780 annually, a 2.9x increase even with member discounts and routine cadence.

Evidence from the industry shows that memberships boost both retention and average client spend.

Retention and churn rates reveal whether your program delivers ongoing value. Membership should dramatically flatten the churn curve compared to typical drop-off patterns.

Monitor subscription duration and dig into exit surveys if tenure falls short of expectations.

A slight improvement in retention can have major impact on revenue and profitability.

Add-on take rates measure how often members purchase extras compared to non-members. It's commonly observed that members, being more engaged and trusting, are more receptive to upsells and cross-sells.

Capacity utilization should improve and balance out. If historically your daycare was at 90% capacity on Fridays but only 50% on Tuesdays, memberships should push you toward more consistent utilization throughout the week.

Every empty slot is lost revenue.

Revenue predictability matters as much as total revenue. Track what proportion comes from recurring versus one-time sources. You ideally want MRR covering a growing base of monthly expenses, making the business less vulnerable to slow periods.

Some operators report revenue increases up to 30% by implementing memberships.

What This Signals

The rise of micro-memberships signals something deeper than a marketing tactic.

Pet care is evolving from standalone events into an ongoing, relationship-driven model.

This mirrors what happened in human services.

Healthcare moved to wellness plans.

Fitness moved to subscriptions.

Pet services are catching up, acknowledging that a pet's needs don't occur in silos and that comprehensive, continuous care yields better outcomes.

The alignment between emotional priorities of pet owners and operational needs of pet businesses is striking.

Pet owners crave assurance, consistency, and belonging.

Pet businesses crave predictability, efficiency, and loyalty.

Micro-memberships deliver both.

Younger pet owners are driving much of this shift. Research indicates that millennials and Gen Z prioritize preventative wellness and ongoing engagement.

They're comfortable with subscription models and actually favor brands that offer subscription-like services.

Services are stepping up as the next growth engine in the pet industry.

Non-vet pet services were around $13B in 2024 U.S. spending and represent one of the fastest-growing segments. The micro-membership trend positions services to drive recurring revenue growth, not just one-time sales.

Rather than this shift being theoretical, we’re already seeing operators bet on the far end of the spectrum — with the emergence of elevated, multi-faceted, members-only pet clubs.

Concepts like Happy Tails in NYC and WagWorks in the UK bundle daycare, grooming, training, social amenities, and premium concierge-style perks under tiered recurring access models.

These aren’t discount punch-card programs, they are lifestyle memberships designed to create community, deliver status, and lock in long-term client relationships through experience, environment, and belonging.

They signal what “pet services as memberships” can look like when pushed to its most premium expression.

The pet industry is modernizing, moving beyond mom-and-pop unpredictability toward sophisticated business models.

For small businesses, this can literally be a lifesaver.

Many pet services are low-margin and seasonal. Turning that into monthly recurring revenue smooths the ride and ensures survival during lean times.

Pet parents' expectations have risen.

They want the same convenience and predictability in pet care that they find in other areas of life. The hassle of booking each appointment and worrying about dynamic pricing or availability is increasingly a turn-off.

This isn't just about revenue optimization.

It's a fundamental shift in how pet care gets delivered. Rather than waiting for pet owners to show up when they need something, the industry is moving to partner with owners throughout the pet's life.

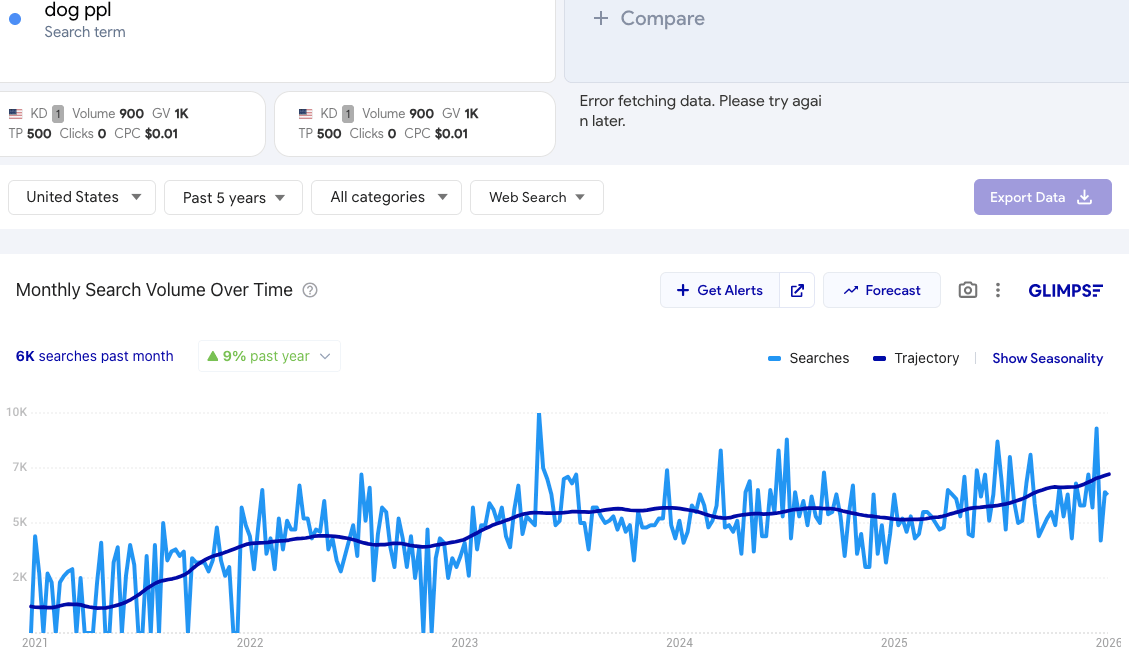

Looks like “dog ppl” has gone from a niche curiosity in 2021 to a legit, steadily growing search term.

The chart shows a choppy month-to-month pattern (lots of spikes and dips), but the long-term trajectory keeps trending upward — especially over the last year, where volume is up ~9% with ~6K searches in the most recent month.

That combo usually signals real, organic interest rather than a one-off viral blip.

The rising baseline suggests more people now know what Dog PPL is and are searching it directly.

Given their expansion to a second NYC location and their positioning as the “members-only dog park / canine social club,” the data kind of reinforces that narrative.

They’re becoming the brand people associate with this emerging category.

The growth isn’t explosive, but it’s durable and compounding, which is what you want to see for a lifestyle-driven, community product.

See you Friday!