- The Woof

- Posts

- The Hardest Growth Moat in Pet CPG

The Hardest Growth Moat in Pet CPG

Radical transparency turned a small treat brand into a growth story.

Issue #240

September 10, 2025

Meet Your AI Assistant for Veterinary Professionals

Running a busy practice means juggling patient care, client communication, and endless notes. That’s where VetRec comes in — the AI Assistant trusted by top practices like Modern Animal, BondVet, Ethos, and Cornell.

VetRec instantly generates SOAP notes, surgery reports, dental charts, and more — all fully customizable and seamlessly integrated with your practice management system. It’s built to save you time, keep your records accurate, and help you focus on what matters most — patient care.

"All I do is read over the recorded notes, revise as needed, attach to medical records, and then I’m done. It’s a game changer!"

— Whitney C. Terrell, DVM

The VetRec x Woof Partner Offer:

Start with a 14-day free trial here

Use code THEWOOF for 50% off your first month

Quick Hits:

Pet food marketing has a trust problem (ruh-roh).

A survey from PETS International and Yummypets found that 68% of US pet owners consider transparent labeling very important, 58% of pet parents across the US, Canada, UK, and France believe current pet food labels are misleading.

Vague terms like "natural" and "premium" are flagged as suspect by 40% of pet owners and have become meaningless noise. The disconnect is clear, brands slap feel-good adjectives on packages, but consumers want verifiable facts.

This transparency gap directly impacts conversion and loyalty. When pet owners can't discern real sourcing differences, they default to price or assume all brands are the same.

But demonstrating concrete sourcing – that your "grass-fed beef" comes from a specific Wyoming ranch with humane certification and batch test results – earns deeper trust.

Nearly 87% of U.S. pet owners would switch to a brand with more humane, carefully sourced ingredients, and over half will pay 15% more for it.

Enter Farm Hounds, a Smyrna, Georgia-based dog treat company that built its entire model around radical transparency.

Their approach?

Show the receipts.

The Farm Hounds Model: Transparency as Operations

Farm Hounds keeps it simple. Single-ingredient treats and chews (beef strips, chicken gizzards, duck neck, pig ears). If it's in the bag, it's on the label. Their "Hog Ear" treat contains exactly that – nothing more.

This radical simplicity eliminates the mystery of unpronounceable ingredients.

But the real differentiator is source disclosure. Farm Hounds prints the actual farm name on each package. When you buy their beef heart treats, the bag reads "Joyce Farms – Winston-Salem, NC" or perhaps "White Oak Pastures – Bluffton, GA."

This isn't fine print marketing copy – it's front-and-center as a promise of origin. Their website features detailed farm profiles, letting customers verify practices themselves.

The third pillar is nose-to-tail sourcing. While typical treat companies use narrow cuts or commodity byproducts, Farm Hounds takes a whole-animal approach with partner farms. They transform parts with no human food market – chicken heads, duck feet, cattle organs, trachea – into nutritious chews.

This creates revenue for farmers from would-be waste while giving dogs biologically appropriate, nutrient-rich treats. They even sell "Leftover Sprinkles" – dehydrated bits from cutting larger treats – as food toppers in an attempt to leave no crumbs behind.

The Heavy Lifting Behind Transparency

Delivering this transparency requires serious operational investment that most brands underestimate.

Supplier Selection Takes Time: Farm Hounds doesn't buy from commodity brokers. They vet family farms practicing high-welfare, regenerative agriculture – like Global Animal Partnership Step 4 certified cattle from Brasstown Beef.

Onboarding can take 6-12 months as farms often aren't set up to save ears, heads, or organs, requiring new processes with their USDA processors.

Some processors must update their HACCP food safety protocols to accommodate these parts. It's a long-term investment in relationships, not just transactions.

Supply Constraints Are Real: Working with actual farms means accepting agricultural rhythms. Animals don't mature on demand. Farm Hounds acknowledges: "We choose to source from working farms, which means animals may not mature on our timetable… at times we do not have access to the products we want or need". Turkey necks might only arrive during fall harvest.

A single cow provides limited ears or tendons. The commitment to single-farm sourcing means they can't substitute ingredients without betraying their label – if "White Oak Pastures" is printed, that's the only acceptable source. So that means no ability to 2x supply in 45 days to satiate impatient amazon customers, and well…that’s a good thing!

Processing Requires Precision: Products are air-dried or freeze-dried to preserve nutrients without additives. This demands strict sanitation between batches to prevent cross-contamination, especially for allergic dogs. Since these aren't high-temperature processes, pathogen control is critical.

Traceability Is Non-Negotiable: Each batch has a lot code tied to a specific farm harvest. While not public-facing as a search tool, these codes enable complete internal trace-back. The farm name on the label serves as the customer-facing transparency artifact.

Behind the scenes, Farm Hounds almost certainly maintains Certificates of Analysis (COAs) and pathogen test results for each batch, which is standard practice for minimally processed animal products. They don’t publish these routinely, but having them available provides an audit trail if a retailer, regulator, or customer ever raises a concern.

Compliance Demands Discipline: Farm Hounds sticks to factual, supportable statements: "100% pasture-raised and humanely raised – no antibiotics or hormones" or functional descriptions like "hair is a natural fiber that helps clean the digestive tract". These descriptions are especially helpful for products that might be completely new to some dog owners.

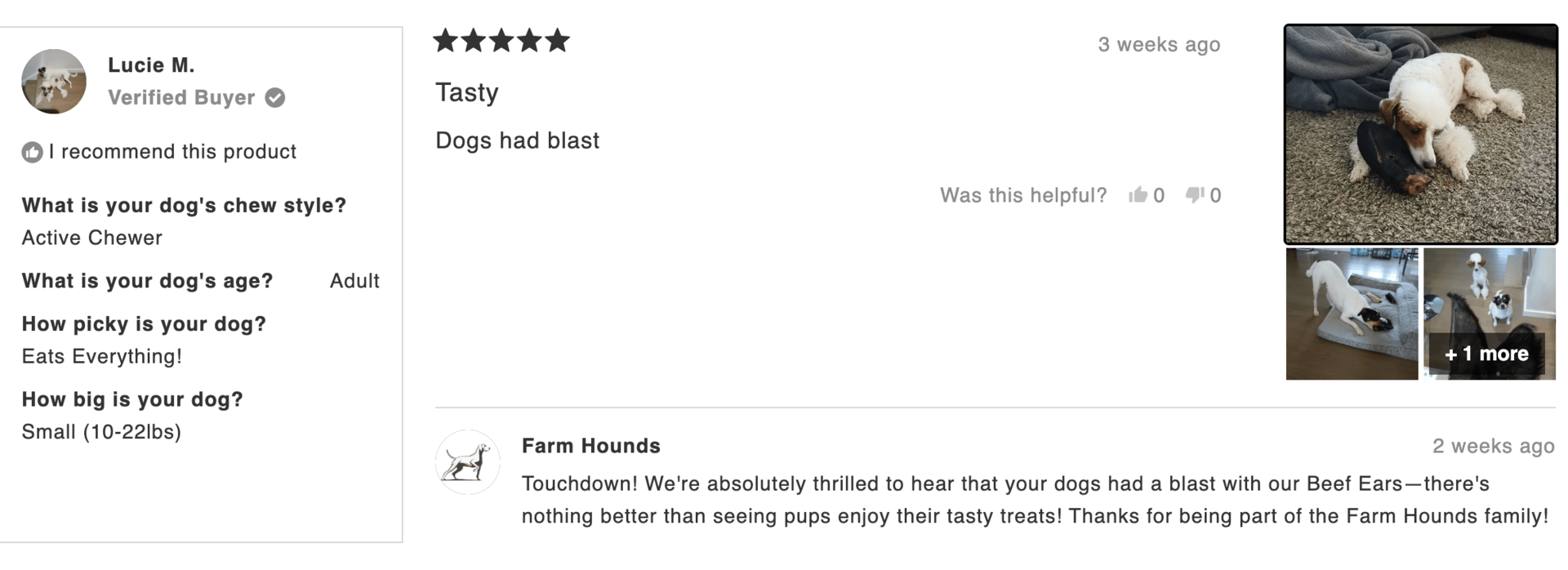

They also bookend their product descriptions and FAQs with fresh reviews of other dogs enjoying that specific product alongside a mini profile of their chew style and level of pickiness, which can provide value to an on the fence dog owner.

The Payoff: Trust Compounds Into Growth

Despite heavy investment and lengthy timelines, Farm Hounds proves transparency pays off through tangible success metrics:

Explosive Growth: Farm Hounds posted a three-year revenue increase of over 2,000%, debuting at #273 on the Inc. 5000 list in 2022. They followed that with #683 in 2023 and #1,112 in 2024, marking 3 consecutive years of recognition among America’s fastest-growing private companies.

Our growth is due to our loyal customers who recognize and appreciate the quality and transparency of the products we sell, which are sourced directly from family farms. Our farm partners represent the best in farming, including applying regenerative agriculture concepts to help the planet, practicing animal welfare to honor the animals they raise, and supporting their communities with organic, locally-grown food.

Customer Evangelism: Reviews specifically cite sourcing and integrity. One recent reviewer posted a 5-star review and said they were the best treats. “…the quality of their treats is top-tier you can tell they truly care about sourcing and transparency…the pricing is super fair for the level of quality you’re getting…”

Retail Expansion: Starting direct-to-consumer, Farm Hounds now sells in 600+ independent pet stores nationwide. Retailers wouldn't dedicate premium shelf space to expensive single-ingredient treats without proven customer demand. They've even expanded into co-packing and private labeling services (if you can’t beat’em, join’em).

Mission Achievement: Beyond sales, Farm Hounds created a beneficial ecosystem. Partner farms have adjusted practices – breeding more pasture poultry or saving male chicks that would've been culled – because Farm Hounds provided a market. The brand's growth directly translates into more animals raised under regenerative, humane conditions with less waste.

What Pet Brands Can Implement in 30 Days

Not every brand can become Farm Hounds overnight, but here are practical steps many pet companies can take immediately:

1. Plain-English Labels: If you can’t rewrite ingredient lists in simple terms. Then consider spelling it out. Educate the consumer on what every ingredient is (a glossary of sorts), what its’ purpose is, and why it’s critical for your product (even for non consumables like grooming products or the materials used in pet gear).

2. Sourcing Snapshots: Pick your hero ingredients and share specifics. Even "sourced from family farms in Wisconsin" or "wild-caught Alaskan salmon, processed in Seattle" builds more trust than vague claims. Create supplier profiles or blog posts (with permission) about your best sources.

3. Process Transparency: Add a "How It's Made" section to product pages and/or to your socials. Go behind the scenes and explain your production method ("Air-dried at 140°F for 48 hours"), safety steps ("batch-tested for pathogens"), and quality measures. Educate customers on what ensures quality – it's the opposite of mysterious factory videos.

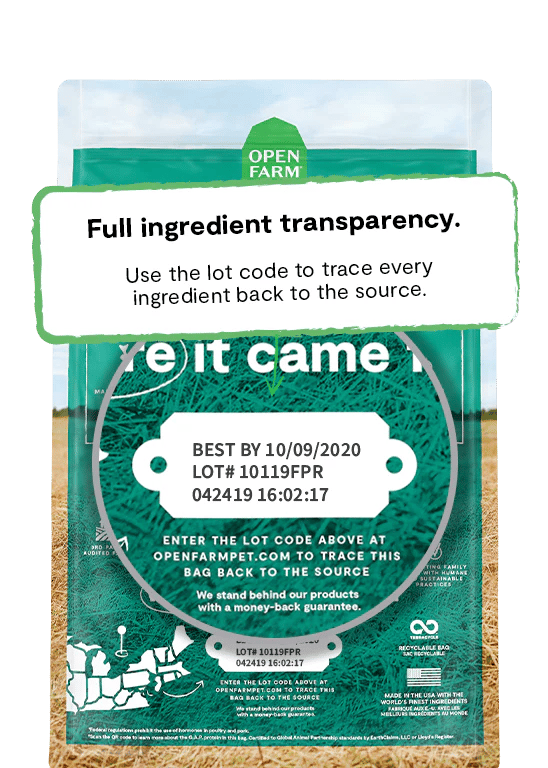

4. Batch Tracking Lite: Launch a simple batch lookup page for flagship products. Let customers enter a lot number or scan a QR code to see production date, facility, and test results. QR codes are increasingly used to share sourcing and quality info in pet food (Open Farm does this well at scale). Start manually if needed – even a basic list builds confidence. I know this is much easier said than done and is a total pain in the ass, but it can go such a long way into building trust and rapport with pet owners.

5. Claims Clean-Up: Audit your marketing language against legal definitions. "Natural" means no synthetic ingredients per AAFCO. "Human-grade" means everything is edible by human standards and made in a human food facility. "Made in USA" should mean virtually all components are domestic per FTC rules. Many companies have technical “workarounds” to be able to use these labels while not being 100% truthful to consumer perception of the label, call that out and show them know how you do it by the book.

Understanding the Trade-Offs

Radical transparency isn't free, nor is it for everybody or every company. Higher costs from specialty sourcing and small-batch processing mean premium pricing – you'll concede the budget segment. Supply constraints from farm partnerships can cause frustrating stockouts. Development cycles slow when you must validate sources before launching products. Documentation and oversight increase administrative overhead permanently.

Not everyone will pay for transparency. You'll hear "Why $15 for a small bag when Brand X charges $8?" Your marketing must justify the premium to a smaller, quality-focused audience initially.

But the ROI comes through lifetime value and brand durability. Customers who value transparency show higher repeat rates and subscription adoption.

Premium pricing escapes commodity wars while maintaining healthy margins. Well-informed customers have fewer surprises, reducing returns and complaints. Your reputation creates compounding marketing efficiency through customer advocacy and earned media.

If you and your team constantly are asking how you can differentiate your brand in a crowded market, here’s one path you could take.

Hard to Copy, Harder to Fake

Transparency isn't a campaign – it's continuous work earning trust ingredient by ingredient, batch by batch. Farm Hounds shows that while the road is resource-intensive, brands that truly show their work create resilient customer bonds. Pet parents become fierce loyalists because they know exactly what they're buying and why it's worth it.

In an industry plagued by recalls and dubious marketing, trust is your strongest moat. It won't be cheap or fast, but transparency scales – turning skeptics into believers, slowly at first, then all at once.

The winners won't just claim to be the best. They'll show the receipts – and invite customers to verify every step.

Searches for “dog chews” have held steady over the past five years, averaging around 90K+ monthly queries in the U.S. with only minor seasonal fluctuations.

The trajectory line shows a slight upward slope since 2021, signaling that demand hasn’t peaked but continues to edge upward. What’s interesting is that this isn’t a fad-driven category, it’s more of a staple purchase.

Dog owners consistently look for chews as part of their dog’s routine, whether for dental health, boredom, or training rewards. That makes it a high-LTV category.

Once pet parents find a chew they trust, they tend to repurchase over and over again.

The kicker here is that Farm Hounds ranks #1 organically for this search term. Even more telling, the top 3 search results are all “natural” dog chews consisting of just a single ingredient.

That’s a strong signal about where the category is heading: away from complex, processed treats and toward transparency and simplicity.

For Farm Hounds, whose entire proposition is built on sourcing and integrity, this alignment is perfect. With nearly 100K searches a month, holding the top spot gives them an outsized advantage - turning steady, high-intent demand into a dependable growth engine without paying for clicks.

See you Friday!