- The Woof

- Posts

- Why 92% of Pet Brand Emails Never Reach Customers

Why 92% of Pet Brand Emails Never Reach Customers

The problem isn’t open rates — it’s inbox placement. Here’s how operators are rebuilding funnels around SMS + email to recover revenue

Issue #285

December 31, 2025

Quick Hits:

🌎️ 2025 saw pets take over the skies, outgrow fast fashion, appear in 40% of ad spots, and much more

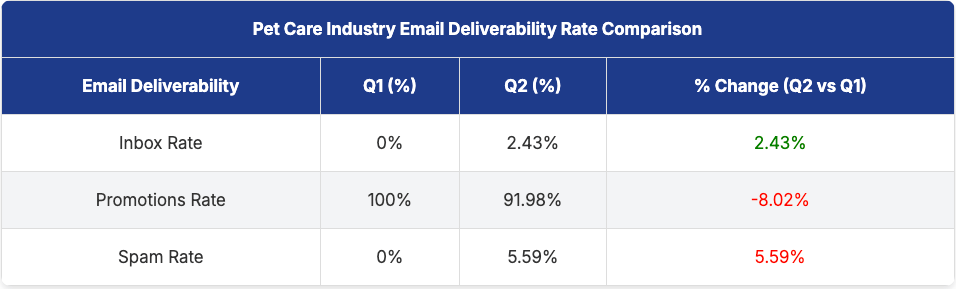

Email marketing in the pet industry feels like it’s quietly falling apart. An analysis of over 2,000 emails from 70 pet product brands in Q2 2025 found that only 2.43% reached customers' primary inboxes, while a staggering 91.98% were relegated to Gmail's Promotions tab and about 5.59% landed in Spam.

This was only a slight improvement over Q1, when essentially 0% hit primary and 100% went to Promotions.

Roughly 98 out of 100 marketing emails pet owners receive never see the light of the main inbox.

What's worse, brands have been sending more emails than ever.

Pet care retailers averaged 2.29 emails per week in Q2, up from 1.85 in Q1, yet performance keeps declining.

The natural instinct to blast out more promotions is actually feeding a vicious cycle where more volume leads to more filtering, which leads marketers to send even more trying to compensate.

Why are pet brand emails getting uniquely punished by inbox algorithms?

A few culprits stand out.

Pet marketers often lean on exuberant sales copy, emoji-filled subject lines, and discount codes in every message.

This "promotion language" is a known trigger for Gmail and Yahoo to divert messages out of Primary.

Many brands hit their lists with daily or near-daily emails, which trains mailbox providers that your domain is generic marketing material.

Some brands still lack proper email authentication like SPF, DKIM, and DMARC.

Google now requires bulk senders to maintain spam rates below 0.3% and include one-click unsubscribe. Without these basics, your emails will never escape the filter gauntlet.

Why SMS Outperforms Email in Pet Care (But Isn't a Silver Bullet)

Given these inbox challenges, savvy pet brands are turning to SMS as a key channel. Text messages have become a high-leverage complement to email, and by the numbers, SMS often dramatically outperforms email in engagement.

SMS open rates range from about 82% up to 98%.

Essentially, the vast majority of texts get read. Compare that to email's roughly 20% average open rate, which is often lower in reality for pet brands languishing in Promotions.

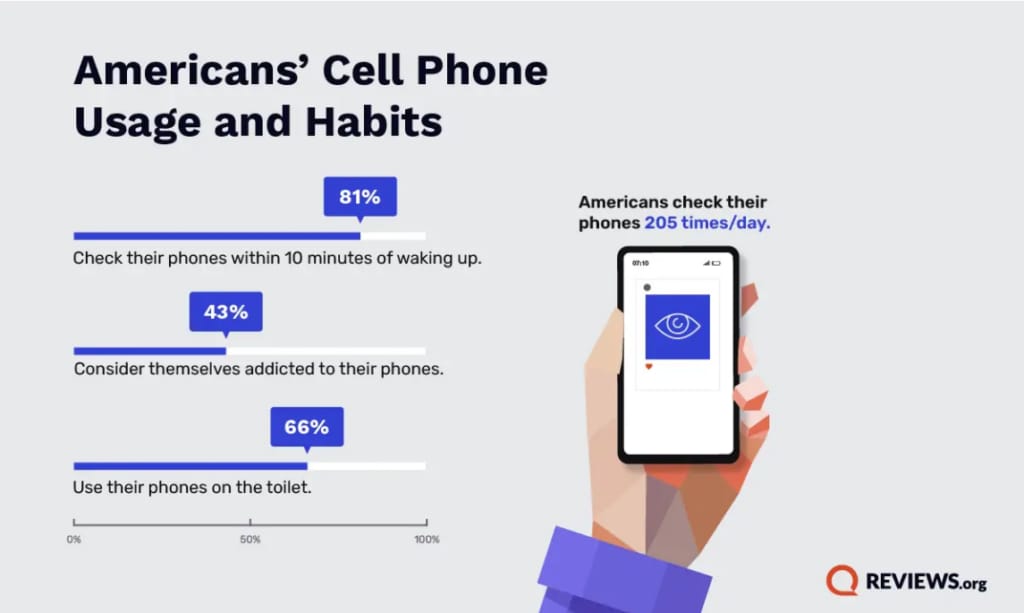

A text doesn't get buried under algorithmic tabs. It buzzes directly in your customer's hand, commanding attention.

Text message marketing sees click-through rates commonly between 20-36%, depending on the industry.

Many pet retailers report around 25% click rates on SMS campaigns. Email, on the other hand, struggles to hit 2-5% CTR on average.

SMS can generate 4-10x more clicks than email per message sent, simply because far more people actually read and tap on the content.

Here's the big one. SMS drives actual purchases. Across industries, SMS conversion rates typically range 21-32% on average. Top-performing text campaigns like abandoned cart texts or limited-time offers can see 30%+ conversion in retail.

Abandoned cart texts convert around 25-39% of the time, numbers email rarely touches.

Why does SMS hit differently in pet care?

Pet owners treat texts with a sense of urgency.

A message about "Your dog's food is running low – time to reorder?" feels timely and important.

Whether it's a prescription refill reminder from a vet or a flash sale on dog toys, SMS taps into that instant alert mindset.

People might ignore an email about 20% off treats for days, but an SMS saying "Bella's food is 5 days from running out – restock now for 15% off" prompts quick action.

Consumers generally still associate text messages with friends, family, and important updates. There's no promotions folder in SMS (yet). So when a pet brand they trust sends a text, it comes across as a personal nudge rather than an ad.

However, SMS is not a magic replacement for email. It's incredibly easy to burn out customers via SMS if misused.

The top reason consumers unsubscribe from brand texts is receiving them too often. 53% of people will opt out if a business texts them too frequently. Unlike email, where someone might just ignore unwanted messages, with SMS they'll actively reply "STOP."

When done right, SMS lists see low churn.

On average, less than 5% of SMS subscribers opt out of campaigns over a given period, whereas email lists naturally degrade around 20% a year through unsubscribes and bounces.

That low opt-out rate holds only if you're sending texts that customers actually find valuable and at a reasonable cadence.

Think of SMS as a scalpel, not a sledgehammer. The brands winning with SMS treat it as a VIP alert channel and integrate it tightly with email.

The Hybrid Funnel Blueprint

Higher SMS engagement doesn't mean you toss email out the window. Many pet brands are rebuilding their customer funnels to use SMS and email in tandem, each for what it does best.

Cart Abandonment Done Right

Every pet e-commerce or service business faces the bane of cart abandonment. On average, 70-75% of shopping carts are abandoned across ecommerce. Some data suggests pet care and veterinary services have slightly lower abandonment rates around 54%, perhaps because urgent needs like vet bookings have higher intent.

Still, that's over half of potential customers slipping away.

The traditional approach has been a couple of follow-up emails. Given email deliverability issues and customers' limited attention, that's no longer enough.

The hybrid approach uses a strategic mix of SMS and email touches spread over several days.

About 30-60 minutes after the cart is abandoned, send a brief, friendly text message. Keep this first SMS light and helpful, not pushy. At this stage, don't offer a discount yet.

Many customers just got distracted, and a simple reminder often does the trick. Only about 5% of brands send any follow-up within 30 minutes via email, but SMS allows you to engage in that golden half-hour window when the purchase is still on their mind.

If the customer hasn't converted from the SMS, an hour or two after abandonment they receive an email reinforcing the cart contents and value with product images and a clear call-to-action.

About 40% of brands send their first cart email within 1 hour, which aligns with best practice.

A day later, introduce urgency or an incentive.

Abandoned cart team leaping into action

Send a second SMS roughly 24 hours after the first email. This plays on FOMO.

Data shows only 18% of first cart emails carry a discount, but by the third email, 59% do. You want to target the incentive to hesitant buyers, not give it to those who might purchase with just a reminder.

If after a few days the cart is still abandoned, send a final follow-up email with a more consultative tone, including testimonials or addressing common reasons for not buying.

A good multi-channel abandonment flow can win back anywhere from 10% up to 30% of abandoned carts.

Email alone usually recovers only 3-11%, a huge difference.

Post-Purchase and Subscription Lifecycle

Winning a sale is just the beginning in pet care, where long-term lifetime value is the real prize. Pet owners tend to become repeat buyers. They have to purchase food, meds, and toys continually, and many sign up for subscriptions.

Consider the stakes.

The average ecommerce customer lifetime value across industries is around $1,609. But pet care customers can be worth even more, with one analysis estimating pet care has one of the highest CLVs at around $2,640 over a 3-5 year period.

This high potential LTV means investing in post-purchase communication is extremely worthwhile.

Immediately after an order, send a confirmation email.

This email has a high open rate, often 60%+ for order confirmations, so use it to set the tone.

A few days after the product is delivered, send an email that is pure value and education with no sales pitch. If they bought a new dog dental chew toy, email them tips for getting their dog comfortable with it.

After giving the customer time with the product, a friendly SMS can go a long way.

Something like "Hi! Just checking in – how are the new cat treats working out for Whiskers? Any questions, we're here to help!"

This kind of two-way conversational SMS builds trust.

For consumable products, time your next messages accordingly. If that bag of dog food typically lasts about 3-4 weeks, send a reminder SMS around day 21.

Don't forget retention tactics like allowing subscription pauses or easy downgrades instead of cancellations.

When companies let subscribers pause instead of cancel, it significantly reduces churn and 51.7% of paused subscribers eventually resume their subscription versus being lost forever.

Yet only about 37% of subscription businesses offer a pause, despite 55% of consumers wanting that flexibility.

Real-World Pet Brand Patterns

Most pet lifecycle strategy discussions focus on the giants like Petco, Chewy, and PetSmart, whose scale and media budgets make them poor role models for smaller operators. More interesting lessons come from challenger brands where funnels, not channels, are doing the real work.

What follows are three patterns we see repeatedly across high-performing pet brands. SMS as a conversion and recovery engine.

Email as a confidence-building and activation system.

Both working together to improve CAC payback and retention.

JoyRide: SMS as a Cart-Recovery Profit Center

JoyRide, a DTC harness and accessories brand, is a useful example of how SMS becomes more than a broadcast channel when it's wired directly into behavioral intent.

Instead of treating SMS as an occasional promo blast, the brand leaned into automated abandoned-cart and conversational recovery flows, using SMS touchpoints shortly after checkout abandonment to re-engage shoppers while intent was still warm.

The results were substantial.

JoyRide generated $1.84M in attributed SMS revenue, a 12.4x ROI, and 23,616 sales through this approach.

Their two-way conversational campaigns achieved a 39.7% reply rate and led to over 2x in conversions and sales compared to one-way blasts.

This was driven by timed SMS outreach within the first 30-60 minutes, follow-up responses to objections or purchase friction, and real-time messaging for sizing, shipping, or product clarification.

The takeaway isn't that SMS replaces email. It's that in high-intent, high-friction moments, especially abandoned carts, SMS captures revenue email often leaves behind.

That means higher realized revenue per session, more efficient CAC payback, and less leakage between add-to-cart and conversion. SMS isn't a campaign channel here. It's a recovery system.

Pawp: Lifecycle Email as an Activation Engine

Pawp, a pet telehealth membership service, is a useful counterpoint because its lifecycle economics are subscription-driven.

In subscription businesses, activation is retention's earliest leading indicator, and Pawp discovered that a lightweight onboarding drip wasn't enough to drive consult usage or long-term value.

A lifecycle marketer expanded their messaging system from a short onboarding sequence over a few days to a 50-day lifecycle program with 27+ behavior-based emails triggered around usage, inactivity, and benefit reinforcement.

That included reminders to book a first consult if unused, nudges tied to specific feature engagement, and contextual education explaining value moments.

The intent wasn't more emails.

It was more relevance, closer to customer behavior (not overly salesy).

Directionally, Pawp reported higher activation rates, stronger conversion from trial to paid, and improved retention versus pure paid acquisition growth.

The commercial insight is subtle but important.

Ads acquire subscribers, but lifecycle messaging determines whether those subscribers ever become revenue.

Email in this case isn't a broadcast channel. It's a usage engine. And when you pair it with SMS for renewal reminders, urgent support handoffs, and time-sensitive access events, you get a coordinated system rather than two disconnected channels.

Wild One: Post-Purchase Email for Confidence, SMS for Timing

Wild One, a DTC pet accessories brand, illustrates a different lifecycle lever. Not abandonment, not subscription, but post-purchase experience shaping.

Instead of flooding customers with discounts after a purchase, Wild One uses post-purchase email as a product education layer, a confidence-building mechanism, and a returns-prevention system.

Typical sequencing includes post-purchase setup and care guidance, early usage expectations around fit and comfort, and check-ins before friction turns into a support ticket.

This is paired with SMS for logistics and timing moments like shipping and delivery status, exchanges and replacements, and replenishment nudges at natural consumption windows.

The brand maintains a dedicated text message subscriber base specifically for early access and special offers, using SMS to reach high-intent customers at moments that matter.

The approach appears to be working.

Wild One has reported 2-3x annual growth since launch without resorting solely to acquisition-heavy spend, which implies strong retention and repeat purchase dynamics driving the business forward.

The impact isn't loud, but it compounds. Fewer early-stage returns. Fewer support escalations. More predictable reorder behavior. Higher customer lifetime value over time.

Email creates understanding and confidence. SMS anchors urgency and timing. Together they reduce friction, and friction is where margin evaporates..

What These Examples Have in Common

These are not channel stories. They are system stories.

JoyRide didn't "do SMS marketing." It built a revenue-recovering abandonment system. Pawp didn't "send more emails." It built an activation and retention system. Wild One didn't "increase post-purchase engagement." It built a friction-reduction system.

Across all three, lifecycle messaging isn't a marketing layer. It's an operating layer that improves CAC payback, stabilizes retention curves, increases realized LTV, and reduces wasted demand spend.

Pet brands that win aren't sending more messages. They're architecting funnels that do the financial work.

What This Means for Pet Operators

The landscape of pet business marketing has fundamentally shifted. Your competitive advantage will come from how you guide the customer journey more than where you place ads or how much you spend.

Deliverability and trust are quiet growth killers or boosters.

If you ignore them, you might pour money into email or ads and see diminishing returns. By fixing deliverability and crafting messages people actually want, you essentially unlock the full value of your existing audience.

Social media is a powerful discovery engine, but it doesn't close the loop.

Your funnel does. Pet parents might find you via a funny Instagram reel or a vet's TikTok advice, but from that point, it's your job to capture them and nurture the relationship.

Many pet DTC brands face a CAC around $78 in 2025, with pet brands often facing higher costs due to heavy competition on Facebook and Google ads.

Progressive brands aim for an LTV:CAC of 3:1 or better. With strong lifecycle marketing, pet companies can push this higher.

The brands that don't adapt will keep seeing declining engagement and rising acquisition costs.

The brands that do adapt by re-architecting their funnel around coordinated SMS and email will reap benefits in customer acquisition cost payback, higher lifetime value, and stronger retention.

In the end, funnels win now, not channels. If you invest in the system that guides your customer from first glance to repeat loyalist, you can afford to navigate whatever platform trends or algorithm changes come your way.

There’s a slow and steady long-term rise in interest for “smart feeder,” but what really stands out are the three giant spikes — each one landing in December 2023, 2024, and 2025.

That timing lines up almost perfectly with holiday gifting behavior. Smart feeders are a higher-consideration, higher-ticket pet tech purchase, so a lot of buyers seem to postpone the spend until gifting season (or take advantage of November-December promo pricing).

It also overlaps with colder-weather, indoor-heavy months when routines tighten up — people travel more, pets get left alone more often, and automation around feeding suddenly feels more “need-to-solve-now” than in the middle of summer.

Outside of those December surges, the baseline trend is still creeping upward, which suggests smart feeders are moving from novelty to normalized household tech — especially among multi-pet homes and busy owners.

The pattern also implies that brands with strong Q4 positioning (bundles, comparison pages, “giftable tech for pets” angles) are likely capturing the bulk of new demand.

See you Friday!