- The Woof

- Posts

- 58% of pet owners are financing vet bills. Meet the pet finance stack.

58% of pet owners are financing vet bills. Meet the pet finance stack.

Insurance, memberships, and credit are converging. Here's what it means for the industry.

Issue #300

February 4, 2026

Join Fear Free® in 2026: Learning That Supports Pets and the People Who Care for Them

Fear Free is an education organization dedicated to preventing and alleviating fear, anxiety, and stress in pets by supporting the professionals who care for them. For veterinary teams and pet care providers, Fear Free membership is designed to support both the emotional experience of pets and the well-being of the people behind the care.

In 2026, Fear Free is expanding its education with new learning tracks, updated topics, and an increased focus on professional wellbeing alongside patient care. Members will have access to all-new webinar series, new on-demand courses, and a refreshed certification experience designed to be practical, engaging, and relevant to real-world care.

Fear Free pairs education with tools and resources that help professionals apply what they learn with confidence. From handling and communication guidance to shareable materials that support team alignment and client understanding, membership helps make Fear Free principles easier to use every day. This helps pros feel more prepared, aligned, and confident in everyday care situations.

Become a Fear Free member in 2026 and be part of a shared commitment to creating calmer experiences for pets and more supported, confident professionals.

Join or renew today and receive 10% off with code FFWOOF26 at fearfree.com

Quick Hits:

🎙️ From BarkBox to BARK Air to BARK TV: the company adds a celebrity interview show to its portfolio

🎉 Today marks our 300th edition (that’s a lot in dog years)

To say thank you, we’re offering 20% off Premium for the next 24 hours

Pet care costs have surged to levels that genuinely shock most owners when they sit down and do the math.

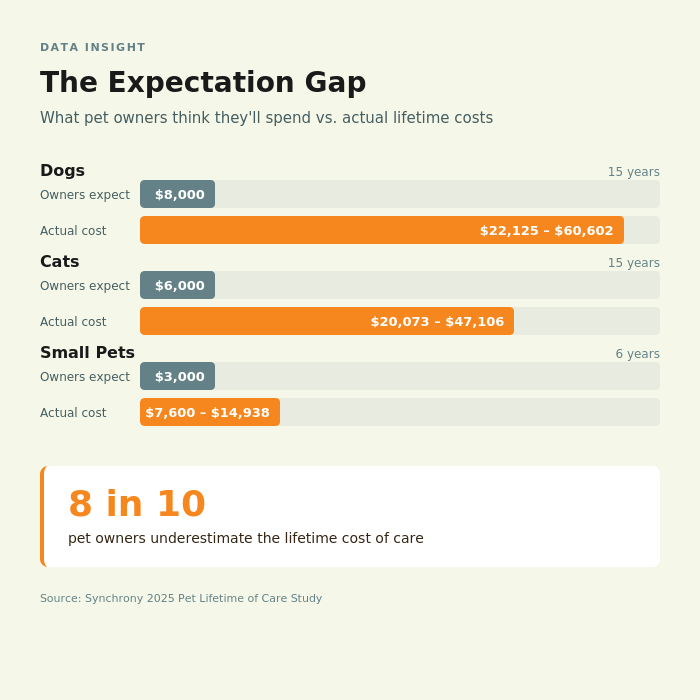

A recent Synchrony study found nearly 8 in 10 pet owners vastly underestimate the lifetime cost of care, which can now exceed $60,000 over a dog's life.

It's no wonder that nearly half of surveyed owners report significant financial worry over unexpected vet bills.

What's interesting isn't just that costs are high. It's how pet parents are responding. They aren't choosing one financial solution and sticking with it.

Instead, they're layering multiple tools together, combining pet insurance, clinic wellness memberships, and lines of credit to build a patchwork safety net for their pet's health.

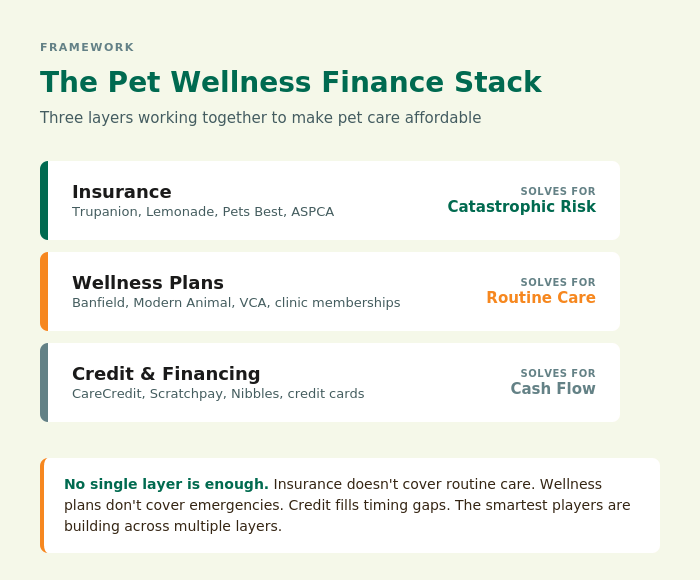

This emerging "pet wellness finance stack" represents a pragmatic response to fragmented costs and unpredictable risk.

Pet owners now juggle monthly insurance premiums, pay-as-you-go routine care plans, and on-demand financing to make sure their pets get the care they need without crushing their cash flow.

The shift is quiet but significant, reshaping how pet businesses design services, price treatments, and build customer loyalty.

How Pet Owners Are Actually Paying for Care

To understand why this stack is taking hold, look at the current payment landscape. The data reveals a market still dominated by out-of-pocket spending, but with new layers creeping in.

The surprise bill problem is real.

Routine vet visits typically cost around $214 for dogs and $138 for cats, but serious emergencies can skyrocket into thousands.

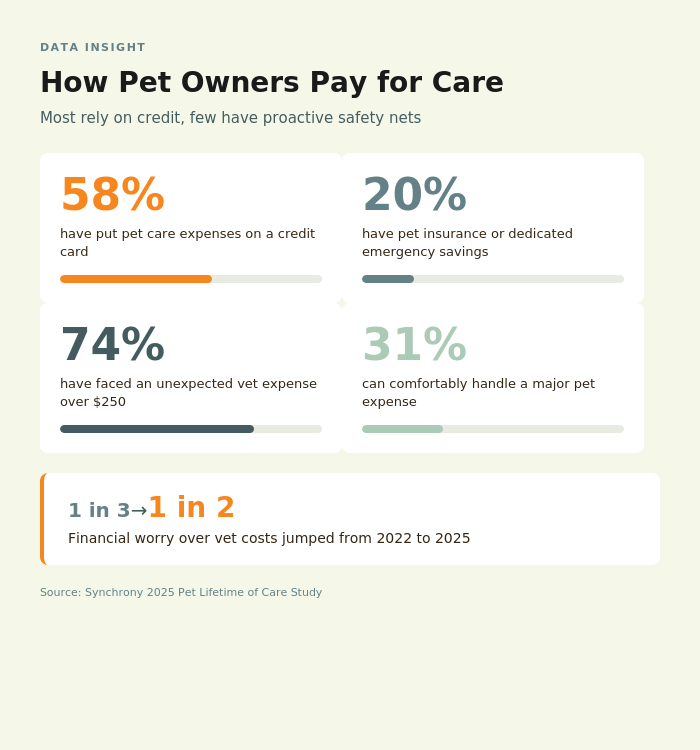

According to Synchrony's research, 74% of pet owners have faced an unexpected vet expense over $250, yet only 31% say they could comfortably handle a major pet bill.

Financial worry around vet costs has jumped from one in three owners in 2022 to nearly one in two in 2025.

Credit cards remain the go-to backup

When faced with hefty invoices, 58% of pet owners have put pet care expenses on a credit card. Credit is the quick "plan B" when cash runs short, but it shifts the burden into the future with interest.

Proactive safety nets are still rare

Only 20% of pet owners have either pet insurance or dedicated savings set aside for pet emergencies. Four out of five pets are medically uninsured and lack a rainy-day fund for vet care.

Insurance is growing fast from a small base

As of 2024, only about 3.9% of U.S. pets are insured, roughly 6.4M out of approximately 164M cats and dogs.

But commercially, the market is surging.

The North American pet insurance market hit $5.2B in premiums in 2024, up roughly 20% from 2023. Over three years it has more than doubled, and analysts project sustained double-digit growth.

Globally, the sector is forecast to grow from about $14B in 2025 to nearly $30B by 2030.

Wellness plans are quietly gaining ground

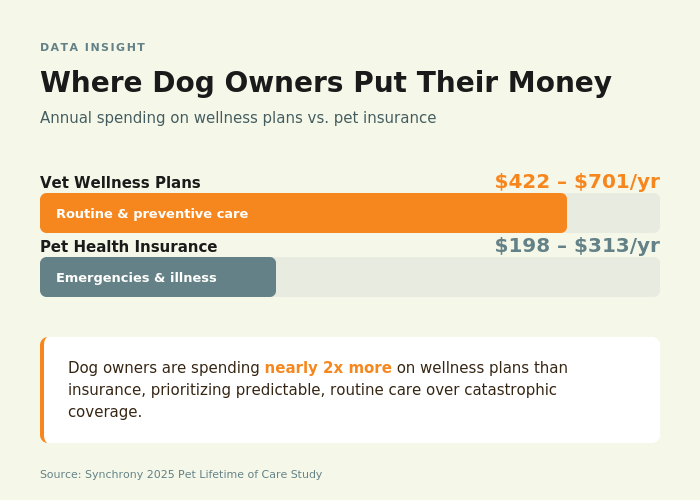

Synchrony's Lifetime of Care study found that dog owners are investing roughly $422 to $701 per year on vet wellness plans, compared to $198 to $313 per year on pet health insurance premiums.

Among those surveyed, spending on wellness memberships is actually outpacing spending on insurance.

These numbers paint a clear picture.

Pet owners are piecing together a financial toolkit, using insurance to offset catastrophic costs, memberships to handle predictable care, and credit to absorb remaining shocks.

The stack won't necessarily reduce the total cost of pet care, but it spreads costs over time, making them more manageable.

Layer 1: Insurance, Growing But Still Mentally "Optional"

Pet insurance forms the top layer of the stack, a safeguard against the big, unpredictable expenses like surgeries, emergency injuries, or chronic illness treatments.

Pay a monthly premium so that a $5,000 surprise vet bill doesn't fall entirely on your shoulders. Strategically, insurance addresses the risk component of pet care costs, converting unforeseen expenses into planned, shared ones.

Yet despite its growth, pet insurance remains psychologically "optional" for most owners.

Unlike auto insurance or human health insurance, it's a voluntary consumer choice that many pet parents forego. The numbers tell the story: only around 4% of U.S. dogs and cats are insured.

A few reasons explain this optional mindset.

Most owners underestimate lifetime costs. If you think your dog's care will only cost $8,000 total when it may be 3-7x that, you might assume expensive emergencies are rare outliers.

There's also the cost-value question. Pet insurance premiums can run $30 to $80 (or over $100 if you have a healthy young pug like me) per month for comprehensive plans.

For a healthy young pet, that feels like an added expense with no immediate return.

Finally, complexity and exclusions have historically given pet insurance a reputation for fine print, with waiting periods, pre-existing condition exclusions, coverage caps, and confusing reimbursement models.

Every time pet insurance says they can’t reimburse me

Despite these hurdles, the trajectory is sharply upward.

As veterinary costs rise and more people treat pets as family, insurance uptake is accelerating.

Some employers have begun offering pet insurance as a voluntary benefit, which normalizes it further.

Surveys show over half of employees would favor jobs that include pet insurance.

Crucially for the stack concept, insurance alone doesn't solve everything. It typically doesn't cover routine care unless added as a rider, and usually requires owners to pay the vet first then wait for reimbursement.

Insurance mitigates the overall cost burden, but not necessarily the immediate cash flow need.

That's where the other layers come in.

Layer 2: Wellness Plans and Memberships, The Interface Layer

Sitting between insurance and out-of-pocket care is the growing layer of wellness plans and pet care memberships.

If insurance is about rare disasters, wellness memberships are about everyday care.

Think of them as the interface layer of the stack, connecting pet owners to routine preventive services via a subscription model and smoothing out the small-to-medium expenses that pop up throughout the year.

These are subscription packages for routine veterinary services.

A pet owner pays a monthly or annual fee and in return gets a bundle of services, typically annual exams, vaccines, screenings, bloodwork, dental cleanings, nail trims, and sometimes perks like unlimited office visits or discounts on medications or “spaw” days…

Our dog’s ideal wellness membership

Unlike insurance, these plans generally cover expected care rather than unforeseen illness or injury.

The rise in memberships offers a win-win.

For owners, wellness plans mean predictable budgeting and accessible preventive care. Rather than worrying about a $300 vet bill here and $200 there, you pay $40 a month and know the basics are covered.

This predictability is huge for cash flow management. It also encourages owners to actually utilize preventive services since they've pre-paid, which can catch health issues early.

For clinics and businesses, memberships lock in recurring revenue and customer loyalty.

Clients on plans come in regularly, boosting visit frequency and engagement. They're less likely to drift to a different vet because they have benefits tied to your business.

The business impact is significant.

According to data from veterinary practice groups, clinics that introduce preventive care plans have seen around 10% revenue growth in the first year, with up to nearly 30% increase in revenue by year three of a client's enrollment.

These clients comply with recommendations at very high rates, over 90% acceptance of suggested services.

Industry surveys note that 81% of consumers say a membership makes them more likely to stay with a brand for purchases, a statistic pet businesses are watching closely.

Pet software company Gingr pitches that embracing memberships can boost a pet business's revenue by up to 30% through steady income and increased client lifetime value.

It's worth noting that wellness memberships aren't limited to vet clinical care.

Grooming salons, dog daycares, training facilities, and pet retailers are all rolling out subscription offerings.

Petco's "Vital Care" program bundles vet checkups with discounts on food and grooming for around $19 a month, effectively a cross-category pet wellness membership.

What wellness plans don't solve is the big-ticket emergency.

They're not insurance, and typically they won't pay for an unexpected surgery or hospitalization.

A pet parent could have a wellness plan covering their vaccines and blood tests, but if the pet tears an ACL, that $4,000 surgery still has to be dealt with via insurance, savings, or financing.

Layer 3: Credit and Financing, The Shock Absorber

Even with insurance and wellness plans in place, there's often a financing layer needed to truly stabilize a pet owner's finances in a crisis.

This is the bottom layer of the stack, the shock absorber that kicks in when a pet needs urgent care tomorrow and there isn't enough cash on hand.

The most common form is still the credit card, as evidenced by the majority of owners who resort to it for vet bills.

But there are also specialized products. Healthcare credit lines like CareCredit are accepted at over 27,000 veterinary practices in the U.S., offering short-term promotional financing that can soften the blow of a large vet bill.

Some veterinarians offer in-house payment plans or partner with fintech "Buy Now, Pay Later" services like Scratchpay or VetBilling.

What's particularly interesting is how the layers of the stack are starting to blend together.

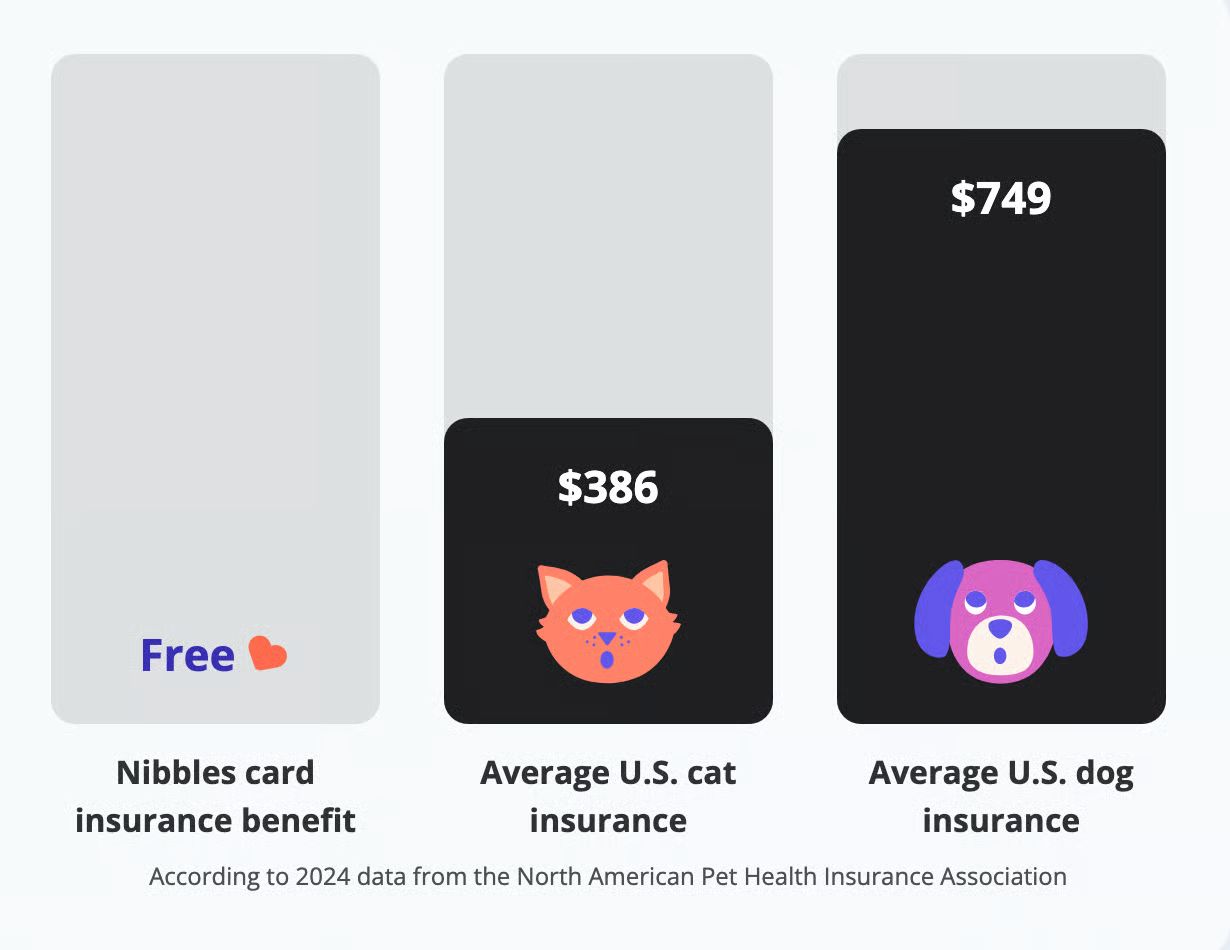

Nibbles, a pet-focused credit card from the founder (read our interview with Rafael here)who scaled ZenBusiness into a unicorn, bundles a year of free pet insurance with every account.

It's a telling sign of where the market is headed. Rather than treating credit and insurance as separate decisions pet owners make at different times, Nibbles collapses them into a single product.

The thinking is straightforward: if most pet owners end up needing credit for vet bills anyway, why not give them insurance coverage from the start?

Even with insurance, pet owners face timing and coverage gaps. Insurance usually reimburses after you pay the vet. If you don't have a few thousand on hand, you may need to charge it and wait for the insurance check.

Also, insurance typically doesn't cover 100%, leaving deductibles, co-pays, and non-covered items.

We're seeing a shift in how credit is presented. It's no longer an afterthought but an integrated offering at point of service.

Veterinary chains and hospitals now often mention payment options alongside treatment estimates. Displaying a simple sign saying "We offer financing options for unexpected costs" can be a relief for a panicked pet owner facing an estimate.

Credit doesn't reduce the expense.

It buys time and flexibility, turning a one-time shock into a series of manageable payments.

Think of it as the last line of defense, catching any costs that slip through insurance and wellness plans.

What This Means for Clinics

Veterinary clinics sit at the front lines of this financial convergence. For clinic owners and operators, several strategic implications emerge.

Offer wellness plans. If you haven't already, consider implementing a clinic wellness membership program. Clinics that introduce preventive care plans have seen notable gains in patient visit frequency and revenue, on the order of a 10% boost in year-one revenue just from plan enrollees. The key is ensuring the package is genuinely valuable and that staff are trained to communicate those benefits.

Embrace insurance. An insured client is often a better-prepared client. They're more likely to approve needed procedures because cost isn't an absolute barrier. Clinics should become fluent in major pet insurance providers, know the basics of how claims work, and consider direct-pay arrangements. Trupanion, for example, offers a system where they pay the vet directly at checkout for the covered portion.

Integrate financing options. Given that well over half of clients might need to use credit for a big bill, offering on-the-spot financing is now standard practice. Clinics should ensure they're signed up with at least one or two pet financing partners. If a client has to independently go find money, they may delay or decline care. If you can say "We can start treatment now and set you up with a payment plan," you preserve the pet's health and avoid losing that business.

Treat the financial conversation as part of the care conversation. Just as you'd discuss treatment options, discuss payment options openly and compassionately. This keeps the focus on the pet's well-being rather than awkward silence or skipped care due to cost embarrassment.

What This Means for Subscription and DTC Brands

The ripple effects extend well beyond vet offices. Pet owners now have multiple recurring commitments, and these influence how they evaluate other pet-related purchases.

Wallet share is getting squeezed. If a family is allocating $50 a month for pet insurance and $30 a month for a vet wellness plan, that $80 is spoken for before they consider discretionary pet spending.

A DTC pet brand, whether it's a monthly toy box or a gourmet treat club, is competing for a smaller remaining wallet share. The bar for "Is this worth another monthly payment?" is higher when they're already juggling multiple pet subscriptions.

Brands should be mindful of subscription fatigue and offer flexible plans or strong loyalty rewards that justify staying subscribed.

Look for bundling opportunities. Rather than existing in a silo, DTC pet brands can seek ways to integrate with the emerging stack. Could a pet food subscription partner with an insurance company to offer a discount to insured pets?

Some pet insurance plans have started offering wellness or product add-ons, like coverage that reimburses for flea preventatives or dietary supplements. A savvy pet wellness startup might bundle multiple aspects together.

The future likely holds more all-in-one pet care subscriptions, so positioning early for partnerships can be a competitive edge.

Broaden your value proposition. A pet owner already in "subscription mode" for pet health might appreciate if your product ties into that mission. A company selling fresh dog food on subscription could enhance retention by adding a wellness component, maybe quarterly virtual Q&A with a vet or integration with health trackers.

The Strategic Takeaway: Build for the Stack

Pet care is no longer a collection of isolated products. It's becoming an interconnected system, and the companies paying attention are already moving.

Modern Animal, a membership-based veterinary network, just hit a $100 million run rate with 85% year-over-year revenue growth.

For $199 a year, members get unlimited clinic exams, 24/7 virtual care, and access to an integrated pharmacy across their 27 locations.

The model works because it collapses what used to be separate transactions into a single relationship.

Chewy has taken a similar approach from the e-commerce side, expanding beyond kibble delivery into Chewy Pharmacy, telehealth consultations, and its own pet insurance offering.

On their website you can now order food, sign up for insurance, and talk to a vet. Meanwhile, Wagmo built its business around standalone wellness plans and has pushed aggressively into employer benefits, recently partnering with bswift to reach 16 million employees.

These aren't random product extensions. They're deliberate plays to own more of the pet wellness finance stack.

The future likely holds even tighter integration.

Perhaps a major pet services company or insurer will roll out something like a "Complete Pet Wellness Plan" for $150 a month that includes full insurance coverage, all preventive vet care at partner clinics, unlimited telehealth, and an emergency financing option.

With more integration, data from each layer can inform the others. An insurance company could offer lower premiums if you're enrolled in a vet's wellness plan, knowing that pet is getting preventive care and therefore presents lower risk.

A financing platform might extend a higher credit line to someone with active insurance, lowering the chance of default.

For anyone operating or investing in the pet industry, this is the strategic landscape to navigate.

Each layer of the stack addresses a different variable in the equation of delivering quality pet care that owners can actually afford. Insurance brings risk pooling for worst-case scenarios.

Memberships bring steady engagement and prevention. Credit brings liquidity when crunch time hits. Combined, they form a more resilient system than any single layer alone.

The key takeaway for businesses is to think in terms of systems, not just SKUs or single services.

Recognize that a pet parent's interaction with you is just one part of their larger journey. How can you add value beyond the immediate product? Identify potential partners in adjacent layers.

The winners in this new landscape often won't go it alone.

The definition of "subscription" in pet care is evolving. It's no longer just treat-of-the-month clubs.

It encompasses health plans, insurance, and financing bundled together. Companies should position themselves not just as vendors of a product, but as nodes in this larger pet care network.

The future of pet care will belong to those who prioritize ecosystems over individual sales. Build for the stack, not the SKU.

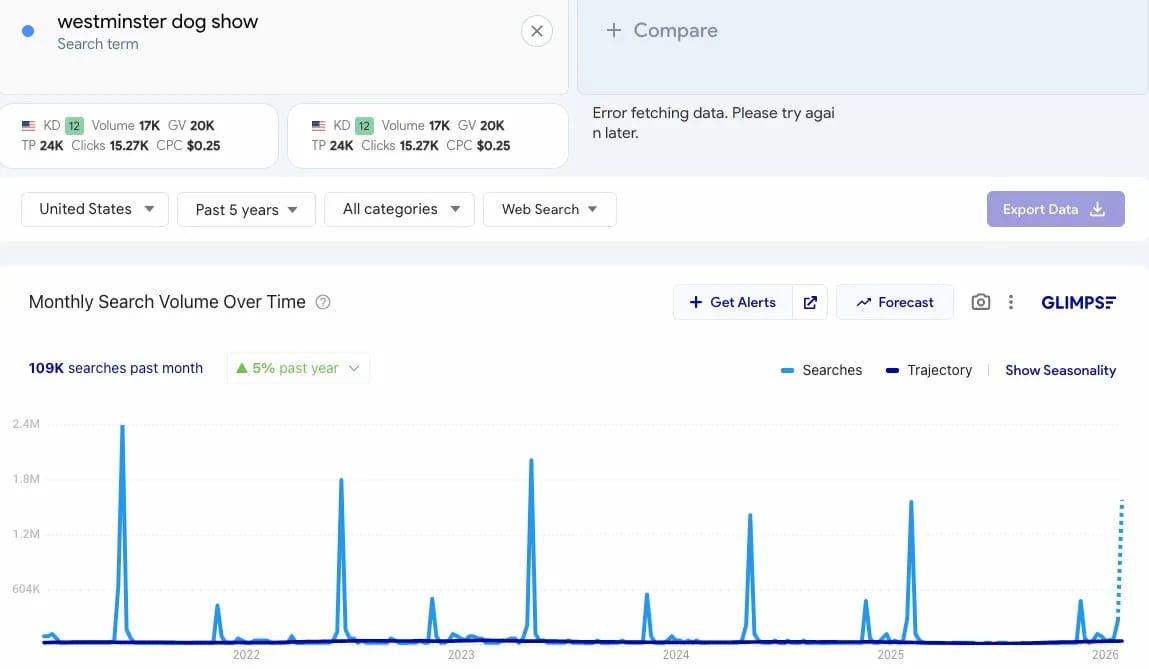

The search data for "Westminster Dog Show" reveals one of the most predictable seasonal patterns in the pet industry. Monthly volume sits at a baseline of roughly 100K searches, but during the show itself (typically held in February), interest explodes into the millions.

The pattern has held steady since 2022, but the peaks are shrinking.

The 2022 spike hit around 2.4M searches, while 2024 and 2025 topped out closer to 1.5M.

That's a 35-40% decline in peak interest over three years, even as baseline volume has remained relatively stable. February 2026 data isn't in yet, so we can't say where this year lands, but the trajectory is clear.

The decline tracks with broader cultural shifts: cord-cutting means fewer people stumbling onto the broadcast, and the cachet of purebred dog shows has been slipping as "adopt don't shop" messaging and mixed-breed enthusiasm have gained ground.

For brands, Westminster isn't irrelevant, but the window is getting smaller and the ceiling is lower.

If you're marketing anything adjacent to breed standards, show-quality grooming, or premium positioning, it still offers a concentrated burst of attention.

Just know that the burst isn't what it used to be, and the drop-off remains steep. This is a sprint, not a slow build, and the track is getting shorter each year.

See you Friday!